[ad_1]

The tech investing party’s above — at the very least for now.

Clean survey information from Organization Technological know-how Research displays a obvious deceleration in paying and a extra careful posture from technological know-how potential buyers. Just this 7 days we observed offer facet downgrades in hardware organizations this kind of as Dell Systems Inc. and HP Inc., and revised assistance from highflier UiPath Inc., citing publicity to Russia, Europe and specified income execution problems.

But these headlines are a canary in the coal mine, pointing to broader tech investing softness. According to ETR evaluation and channel checks in theCUBE community, the true story is that these problems are not isolated. Rather, we’re viewing indications of warning from prospective buyers throughout the board in business tech.

In this Breaking Assessment, we are the bearers of poor information, reasonably speaking. We’ll share a very first appear at new info that counsel a tightening in tech paying out, contacting for 6% advancement this year, which is underneath our January prediction of 8% for 2022.

The celebration is ending – at the very least for a whilst

It’s really not stunning, proper? We have had a two-12 months record run in tech spending and massive rises in substantial-flying engineering stocks. Hybrid operate, equipping and securing distant staff, the forced march to digital… these have been all sizeable tailwinds for tech corporations.

The Nasdaq peaked late past calendar year and then, as you can see in the chart previously mentioned, bottomed in mid-March. Then it manufactured a nice run up as a result of the 29th of last month. But the mini-rally seems to be in jeopardy. With Fed fee hikes, Russia and supply chain worries, there is loads of uncertainty. So we should really expect the C-suite to be declaring, “Slow down.”

We do not consider the concerns are confined to businesses with publicity to Russia and Europe. We assume it’s additional wide-primarily based and warning from know-how providers and tech consumers is prudent.

Unfortunately, it looks like the two-year get together has ended and, as our ETR colleague Erik Bradley said, “a minimal hangover shouldn’t be a shock to any individual.”

New expending info factors to a considerably less optimistic 2022

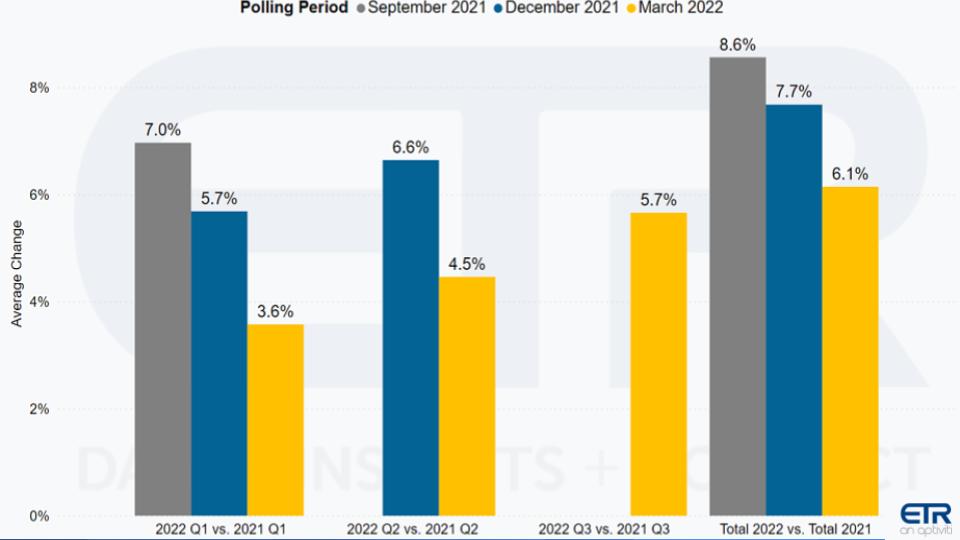

We’re constrained in what we can share with you right now due to the fact ETR is in its quiet interval and has not launched comprehensive outcomes yet outside the house its non-public client foundation. But it did put out an warn today and we can share the slide earlier mentioned. It exhibits the expectation on paying progress from extra than a thousand main information officer and details technological innovation customer respondents.

The key aim areas in this information are the yellow bars, which depict the most modern study data as in contrast with the blue and gray bars – which are the December and September 2021 results, respectively. You can see a steep fall from past calendar year in Q1, decreased anticipations for Q2 and, at the far suitable, a drop from almost 9% very last September and around 8% in December to just in excess of 6% today.

Now you may possibly assume a 200-basis point downgrade from our prediction in January of 8% would seem relatively benign. But in a $4 trillion market, which is $80 billion coming off the cash flow statements of tech providers.

The fantastic news is that 6% advancement is however pretty sturdy and increased than pre-pandemic paying out amounts.

The buyers we’ve talked to this week are stating: “Look, we’re even now spending… we just have to be extra circumspect about in which and how quick.”

Other noteworthy paying out highlights

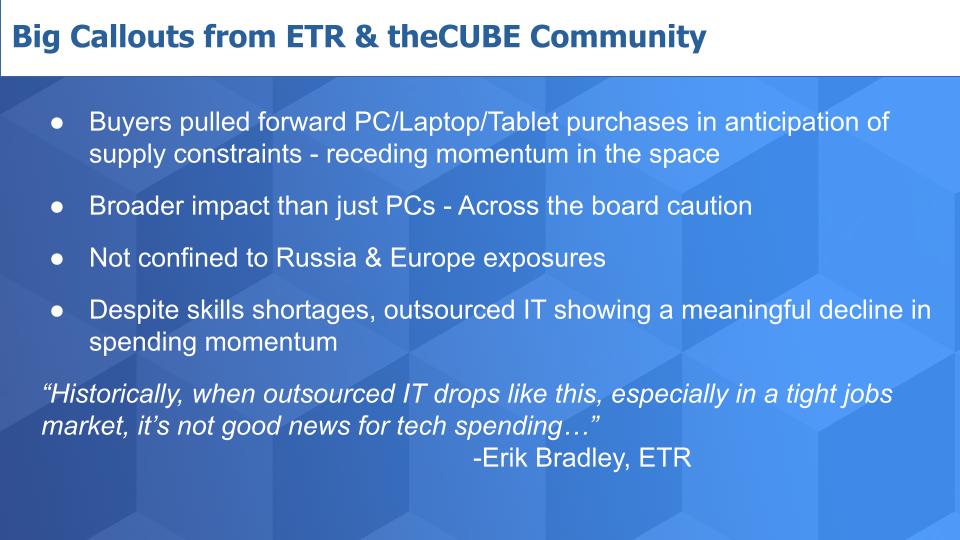

There were a number of other contact-outs in the ETR details, in our conversations with Erik Bradley and in the outreach to theCUBE group.

Initially, it appears to be as if buyers, in reaction to envisioned offer constraints, pulled forward their orders late last yr and previously this year. Don’t forget when we couldn’t get toilet tissue? Individuals started out to stockpile and that designed a “rubber banding influence.” So we noticed very similar stockpiling and are now seeing momentum recede in the private computer and laptop computer industry.

But as we said, this is not isolated to PCs. UiPath’s earnings guidance confirmed this, but the story does not close there. This is not isolated to UiPath, in our view. Somewhat, it is a extra broad-centered slowdown.

The other big indicator is shelling out in outsourced IT, which is demonstrating a significant deceleration in the hottest survey. Net Rating in this sector dropped from 13% in January to 6% currently. Internet Score is a evaluate of the net share of consumers in the survey that, on harmony, are spending much more than they were previous study. It’s in essence derived by subtracting the proportion of consumers investing fewer from those investing more.

That signifies a 700-foundation position fall in 3 months — in a marketplace wherever you just can’t hire enough individuals. The share of providers hiring has long gone from 10% through the pandemic to 50% currently, in accordance to ETR information. And we know there is nonetheless an acute expertise lack. So you would expect more IT outsourcing, but it is down.

This assertion from ETR’s Erik Bradley points out more:

Traditionally, when outsourced IT drops like this, primarily in a limited careers market place, it is not very good information for tech paying out.

Tech names with European publicity and further than

The other fascinating phone-out from ETR were particular business names that show up to be viewing the major change in shelling out momentum. There is a aim on Europe, but it’s far more wide-based, we believe.

The higher than graphic lists the major variations at the margin.

SAP SE has significant exposure to on-premises installations. ServiceNow Inc. has European exposure and also wide-based mostly exposure in IT. Zoom Video Communications Inc. did not go to the moon — no shock offered the quasi-return to function and Zoom tiredness.

McAfee Corp. is a concern since safety seems to be the one area that is considerably insulated from the paying out warning. Okta Inc. had the hack and we’re heading to protect that following 7 days with some new information from ETR but normally protection has been keeping up properly – CrowdStrike Holdings Inc. and Zscaler Inc. in particular.

Adobe Inc. is an additional company that experienced a good bounce in the last pair of months. Accenture plc speaks to the outsourcing headwinds we stated earlier.

The callout for Google Cloud System is a bit of a issue. It is a identify that is continue to elevated in total, but down from its past stages. And properly down in Europe – under that magic 40% Internet Rating mark that we from time to time like to cite as the elevated Net Score level.

What to count on from listed here

The ARKK expenditure stocks of Cathie Wood fame have been monitoring on a downward craze considering the fact that past November, that means they are creating decreased highs and decrease lows considering that then. The pattern is not their good friend.

Traders we talk with are being considerably much more careful about buying the dip in tech. They’re increasing cash on the upswings and getting far more affected individual. Traders can purchase in this natural environment and hedge their bets with limited performs. But except you can pay back awareness by the minute and you know what you are undertaking, you’re going to get whipsawed. That could take place even if you’re a professional.

Traders inform us they are even now eyeing big tech. Even while Apple Inc. has been on a recent tear and has some publicity. They’ll appear for entry points in the chop for Apple, Amazon.com Inc., Microsoft Corp. and Alphabet Inc.

And to worry once again, 6% investing growth is nevertheless quite sound. We’re basically resetting the outlook relative to prior expectations because of to some unexpected components this kind of as Ukraine.

When you zoom out and search at the growth in knowledge, receiving electronic suitable, safety investments, automation, cloud, AI, containers and new regions of growth this kind of as telco and 5G, the fundamentals have not altered. These systems are all powering the new digital financial state and we consider these developments symbolize a prudent pause compared to a change in the worth of tech.

A person position of caution is that there is a large amount of dialogue all over a shift in international economies, source chain uncertainty, persistent semiconductor shortages – in particular in locations these types of as driver chips and parts for shows, analog elements, microcontrollers, ability regulators and the like. it is a bunch of unexciting but crucial things that is not participating in pleasant these times. And this results in uncertainty, which at times picks up momentum.

Don’t be astonished to see savvy chief money officers task tepid steering on impending earnings phone calls.

Managements will normally choose edge of wide-primarily based adverse sentiment to let a little air out of anticipations and experience the choppiness with the herd. There’s genuinely not a ton of upside for corporations to fight trend in this industry until sentiment and technicals adjust study course.

We’re observing these trends intently and we’ll be vigilant – reporting to you when we see changes in the data, and in our forecasts.

Retain in touch

Many thanks to Stephanie Chan, who investigated many subject areas for this episode, and to Alex Myerson on creation. Alex handles the podcasts and media workflows. And special many thanks to Kristen Martin and Cheryl Knight, who assistance us continue to keep our local community informed and get the phrase out.

Recall we publish each week on Wikibon and SiliconANGLE. These episodes are all offered as podcasts wherever you listen.

Email [email protected], DM @dvellante on Twitter and remark on our LinkedIn posts.

Also, test out this ETR Tutorial we made, which describes the expending methodology in far more depth. Note: ETR is a individual corporation from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s details, or inquire about its companies, you should make contact with ETR at [email protected].

Here’s the total video examination:

https://www.youtube.com/check out?v=XB3C9oefcEs

All statements produced about firms or securities are strictly beliefs, factors of see and thoughts held by SiliconANGLE media, Company Know-how Study, other visitors on theCUBE and guest writers. This kind of statements are not tips by these people to invest in, sell or maintain any safety. The content material introduced does not represent financial investment information and ought to not be made use of as the foundation for any investment determination. You and only you are dependable for your investment selections.

Graphic: corepics/Adobe Stock

Present your aid for our mission by signing up for our Dice Club and Dice Party Community of professionals. Join the local community that contains Amazon Net Services and Amazon.com CEO Andy Jassy, Dell Systems founder and CEO Michael Dell, Intel CEO Pat Gelsinger and several more luminaries and industry experts.

[ad_2]

Source website link

More Stories

Why Information Technology is Key to Growth

Information Technology: Your Pathway to Innovation

Unlocking the Future of Information Technology