Intercontinental Business Machines (IBM) – Get Report was having it on the chin on Friday, down 9.5% following reporting earnings.

The business just simply cannot feel to impress Wall Road – no make any difference what it does.

With the decrease, shares have fallen 25% from the one-year higher. Even worse, when not modifying the price for dividends, IBM is down about 11% around the very last ten years.

Earnings of $2.07 a share slumped additional than 50% 12 months in excess of 12 months, but beat anticipations of $1.79 a share.

But as is generally the challenge, earnings disappointed Wall Avenue, slumping 6% year over calendar year and lacking analysts’ anticipations.

Other big-cap legacy tech players ended up having a hard working day on Friday, with Intel (INTC) – Get Report down on earnings as properly. Oracle (ORCL) – Get Report was declining as well, very likely as Goldman Sachs analysts identified as it a promote.

The effectiveness of its friends just isn’t helping IBM’s trigger. Let’s glance at the charts.

Buying and selling IBM

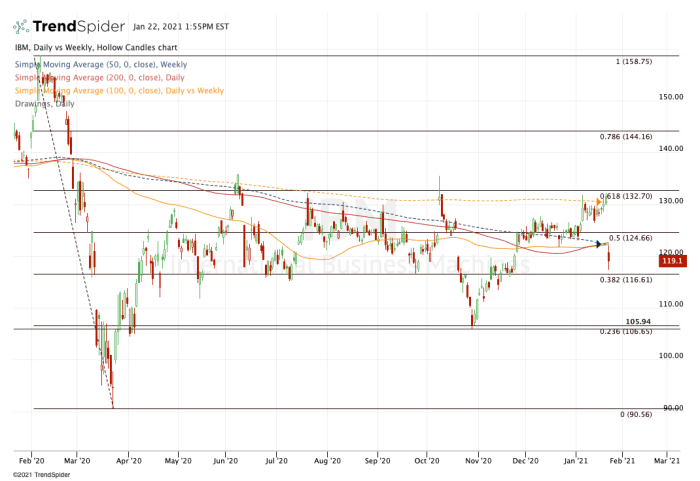

You will notice that this stock never really coated its coronavirus losses like the rest of tech.

IBM stock was contained by its 50-week and 100-week going averages, as nicely as the 61.8% retracement. Mixed, the group has permitted the stock to near previously mentioned all a few steps just when considering that June 1.

Now gapping underneath its 50-working day, 100-working day and 200-working day transferring averages, self esteem between the bulls need to be cratering. If it is not, it should be.

From here although, we do have some distinct assortment amounts to maintain in mind.

Largely talking, the 38.2% retracement has been guidance at $116.61. A shut underneath this stage could place a massive decline down toward $106 in enjoy. That degree has been important around the several years, although also serving as the 23.6% retracement for the 2020 assortment.

On the upside, it’s pretty simple: bulls needs to see IBM inventory to reclaim the 100-working day, 200-working day and 50-week shifting averages.

Earlier mentioned the 50% retracement in the vicinity of $124.70 and the stock could commence to fill the hole up to $130.

Having said that, it is challenging to be wildly optimistic at this stage, specified the put up-earnings price tag motion. For traders that are optimistic, hold out for rate to confirm initially.

More Stories

How News Technology is Shaping Public Opinion

Exploring Ethics in News Technology Practices

News Technology: Enhancing Audience Engagement