PAX Worldwide Know-how (HKG:327) has experienced a excellent operate on the share industry with its stock up by a sizeable 22% above the final thirty day period. Specified the company’s spectacular effectiveness, we decided to research its financial indicators much more carefully as a firm’s financial overall health above the long-expression usually dictates market place outcomes. Exclusively, we made the decision to analyze PAX World Technology’s ROE in this article.

Return on fairness or ROE is an critical element to be deemed by a shareholder due to the fact it tells them how correctly their cash is becoming reinvested. In other phrases, it is a profitability ratio which measures the rate of return on the money offered by the firm’s shareholders.

See our most up-to-date evaluation for PAX World wide Technological know-how

How Do You Estimate Return On Fairness?

The method for ROE is:

Return on Fairness = Net Revenue (from continuing functions) ÷ Shareholders’ Fairness

So, based mostly on the earlier mentioned system, the ROE for PAX World Technological know-how is:

17% = HK$1.0b ÷ HK$6.0b (Centered on the trailing twelve months to June 2021).

The ‘return’ is the amount of money gained following tax more than the final twelve months. A single way to conceptualize this is that for each individual HK$1 of shareholders’ funds it has, the enterprise made HK$.17 in profit.

Why Is ROE Important For Earnings Progress?

So much, we have figured out that ROE is a evaluate of a firm’s profitability. Based on how a great deal of these earnings the business reinvests or “retains”, and how properly it does so, we are then ready to assess a company’s earnings progress potential. Assuming every little thing else continues to be unchanged, the better the ROE and earnings retention, the larger the advancement rate of a organization as opposed to businesses that really don’t always bear these properties.

PAX World wide Technology’s Earnings Growth And 17% ROE

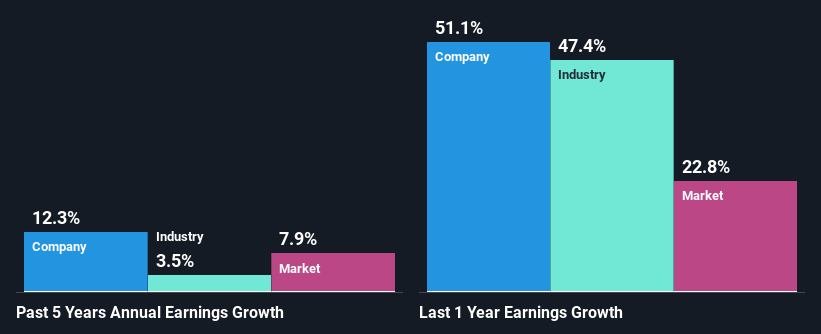

At 1st glance, PAX Worldwide Technological innovation would seem to have a first rate ROE. Even further, the company’s ROE compares rather favorably to the business average of 9.2%. This surely provides some context to PAX World-wide Technology’s decent 12% internet earnings development seen in excess of the previous five several years.

Next, on evaluating with the sector net revenue expansion, we located that PAX World-wide Technology’s advancement is pretty high when when compared to the field average growth of 3.5% in the identical period, which is good to see.

Earnings growth is a enormous element in stock valuation. It’s essential for an trader to know whether or not the current market has priced in the company’s anticipated earnings progress (or drop). This then can help them decide if the stock is put for a brilliant or bleak foreseeable future. Is PAX Worldwide Technologies relatively valued as opposed to other businesses? These 3 valuation steps might help you determine.

Is PAX World-wide Technological innovation Producing Effective Use Of Its Income?

PAX World-wide Technological know-how has a low a few-year median payout ratio of 19%, that means that the firm retains the remaining 81% of its income. This implies that the management is reinvesting most of the gains to develop the enterprise.

Also, PAX International Technological innovation has paid out dividends around a time period of six many years which means that the organization is fairly really serious about sharing its earnings with shareholders. On the lookout at the latest analyst consensus details, we can see that the company’s long run payout ratio is envisioned to rise to 26% about the next 3 years. In spite of the higher predicted payout ratio, the firm’s ROE is not predicted to modify by considerably.

Summary

On the whole, we feel that PAX World Technology’s effectiveness has been very great. Particularly, we like that the business is reinvesting a massive chunk of its revenue at a superior amount of return. This of program has induced the company to see significant growth in its earnings. With that reported, the most recent marketplace analyst forecasts reveal that the firm’s earnings are anticipated to accelerate. Are these analysts anticipations primarily based on the wide anticipations for the industry, or on the company’s fundamentals? Click here to be taken to our analyst’s forecasts page for the corporation.

When buying and selling shares or any other financial investment, use the platform considered by several to be the Professional’s Gateway to the Worlds Sector, Interactive Brokers. You get the most affordable-value* investing on stocks, solutions, futures, foreign exchange, bonds and resources all over the world from a one integrated account. Promoted

This posting by Merely Wall St is basic in mother nature. We deliver commentary centered on historical facts and analyst forecasts only making use of an unbiased methodology and our content are not meant to be fiscal suggestions. It does not represent a recommendation to obtain or provide any stock, and does not acquire account of your aims, or your economic predicament. We intention to bring you prolonged-term focused assessment driven by elementary info. Note that our investigation could not element in the most up-to-date price-delicate firm announcements or qualitative material. Only Wall St has no place in any stocks talked about.

*Interactive Brokers Rated Least expensive Value Broker by StockBrokers.com Annual Online Review 2020

Have comments on this report? Concerned about the content material? Get in contact with us straight. Alternatively, e mail editorial-workforce (at) simplywallst.com.

More Stories

Harnessing Technology Global for Sustainable Development

The Power of Collaboration in Technology Global

How Technology Global is Revolutionizing Education