[ad_1]

Despite fears of inflation, supply chain issues, skyrocketing energy and home prices, and global instability caused by the Ukraine crisis, chief information officers and information technology buyers continue to expect overall spending to increase more than 6% in 2022.

Although this is lower than our 8% prediction made in January of this year, it remains in line with last year’s roughly 6% to 7% growth and is holding firm with the expectations reported by tech executives last quarter.

In this Breaking Analysis, we update you on our latest look at tech spending with a preliminary take from ETR’s latest macro drill-down survey. We’ll share some insights as to which vendors have shown the biggest change in spending trajectory and ask the technical analysts in our community to give us a read on what they think it means for technology stocks going forward.

Spending sentiment among IT buyers remains solid

In the past two months we’ve had conversations with dozens of CIOs, chief data officers, data executives, IT managers and application developers. Across the board they’ve indicated that, for now at least, their spending levels remain largely unchanged. The latest ETR drill-down data, which we’ll share shortly, confirms these anecdotal checks.

However, the interpretation of this data is nuanced. Part of the reason for the spending levels are holding up is inflation. Stuff costs more so spending levels are higher, forcing IT managers to prioritize. Security remains the No. 1 priority and is less susceptible to cuts. Cloud migration, productivity initiatives and data projects remain top priorities.

So where are CIOs robbing from Peter to pay Paul? We’ve seen a slight uptick in certain speculative IT projects being put on hold and, according to ETR survey data, we’ve seen some hiring freezes reported, especially notable in the healthcare sector.

Vendor consolidation is the most-cited savings tactic

ETR also surveyed its buyer base to find out where they were adjusting their budgets. Consolidating IT vendors was by far the most cited tactic. This makes sense as companies, in an effort to negotiate better deals, will often forgo investments in newer best of breed technologies and bundle in products and services from larger suppliers, even though they may not be as functional.

ETR survey respondents also cited cutting the cloud bill where discretionary spending was in play. We certainly saw this with some of the largest Snowflake Inc. customers this past quarter where even though they were still growing consumption rapidly, certain customers dialed down their consumption and pushed spending off to future quarters. Remember, in the case of Snowflake anyway, customers negotiate consumption rates based on a total commitment over a period of time. So although they may consume less in one quarter, over the lifetime of the contract, Snowflake (and several other cloud companies) have good visibility on the lifetime value of a deal.

Buyers expect spending levels to remain stable (for now)

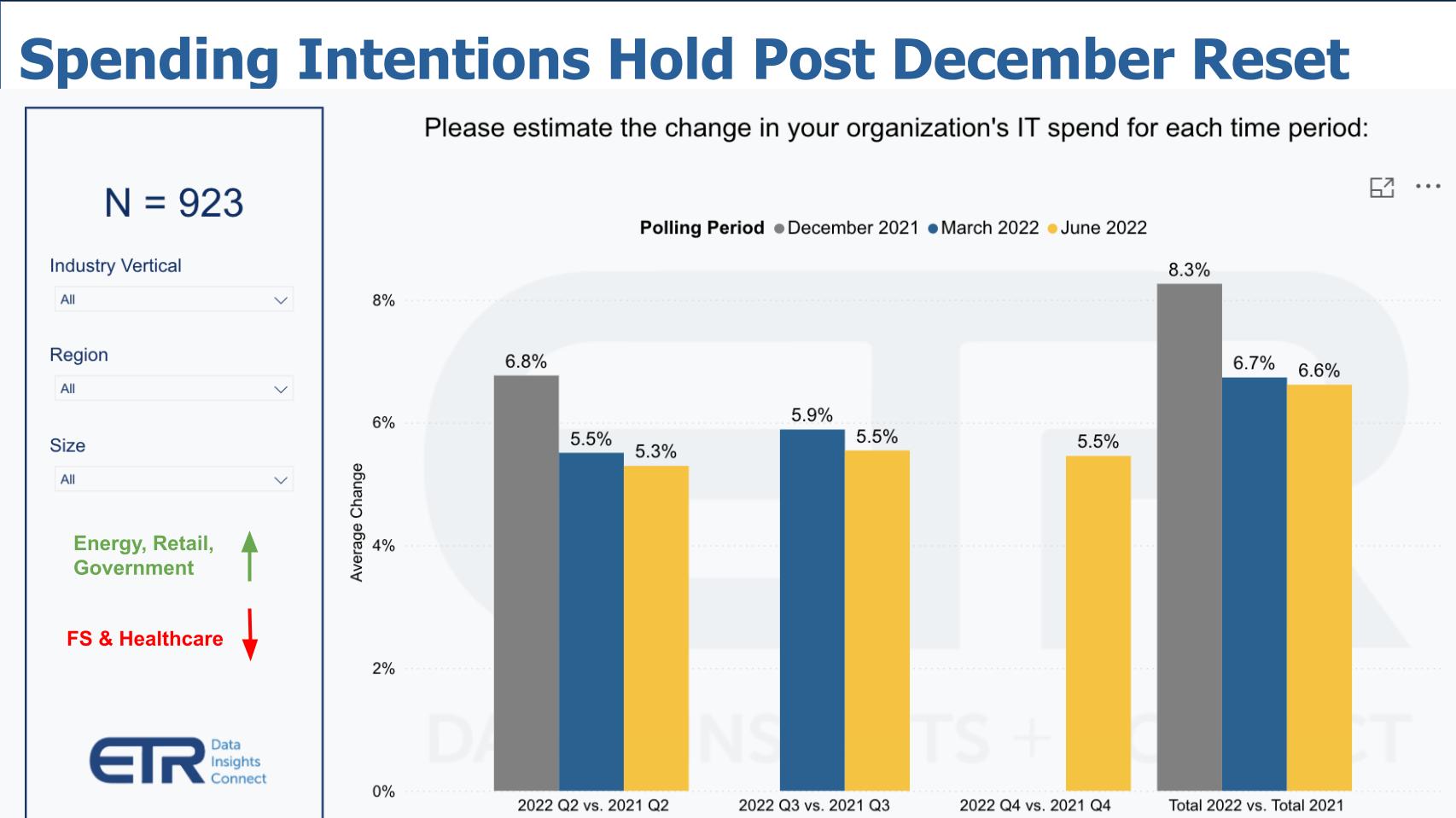

The chart above shows the latest ETR spending expectations among more than 900 respondents. The bars represent spending growth expectations from the periods of December 2021 (gray bars); the March of 2022 survey (blue); and the most recent June data (yellow).

You can see the expectation for spending in the quarter is down slightly in the mid 5% range but overall for the year, expectations remain in the mid-6% levels. This figure is down from 8%+ in December, where it looked like 2022 was going to have more momentum than even last year. Remember this was before Russia invaded Ukraine, which occurred in mid-February of this year.

Generally speaking, CIOs have told us that their chief financial officers have lowered their earnings outlooks for Wall Street. They’ve told us that unless and until these revised forecasts appear at risk, they continue to expect their spending levels to remain pretty constant.

Plenty of spending momentum on specific vendor platforms: Security firms lead the pack

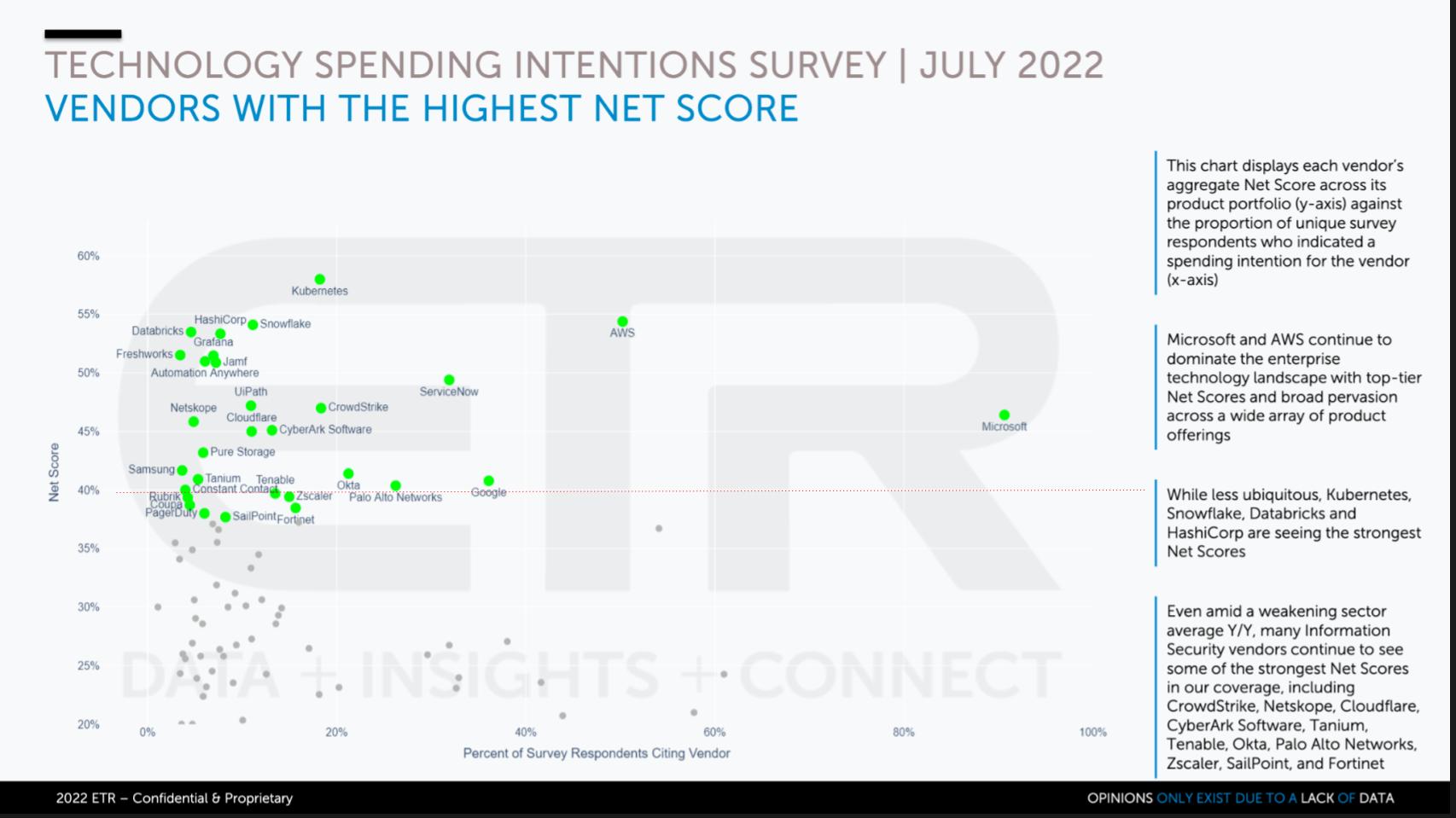

The chart above shows the companies with the greatest spending momentum as measured by ETR’s proprietary Net Score methodology. Net Score measures the net percentage of customers spending more on a particular platform. That measurement is shown on the Y axis. The red line inserted at 40% is a highly elevated marker and the green dots are companies in the ETR survey that are near or above that line. The X axis measures the presence or pervasiveness in the data set.

Now, of course, Kubernetes is not a company but it remains an area where organizations are spending lots of resources and time – particularly to modernize and mobilize applications. Snowflake remains the company that leads all firms in spending velocity, but as you’ll see momentarily, despite its highest position, it’s down from previous levels in the high 70% to the low 80% range.

Amazon Web Services Inc. is incredibly impressive because it has an elevated level but also a huge presence in the survey. Same with Microsoft Corp. Same with ServiceNow Inc., which stands out. And you can see the other smaller vendors such as HashiCorp, which is increasingly being seen as a cross-cloud enabler, showing elevated spending momentum. The robotic process automation vendors, Automation Anywhere Inc. and UiPath Inc., are in elevated territory. But it’s the security companies that really stand out. CrowdStrike Holdings Inc., CyberArk Inc., Netskope Inc., Cloudflare Inc., Tenable Inc., Okta Inc., Zscaler Inc., Palo Alto Networks Inc., SailPoint Technologies Holdings Inc. and Fortinet Inc. are all showing elevated levels with many cybersecurity firms hovering at or above the 40% mark.

Pure Storage Inc. remains elevated, as do PagerDuty Inc. and Coupa Software Inc.

There’s plenty of good news here despite the tech crash.

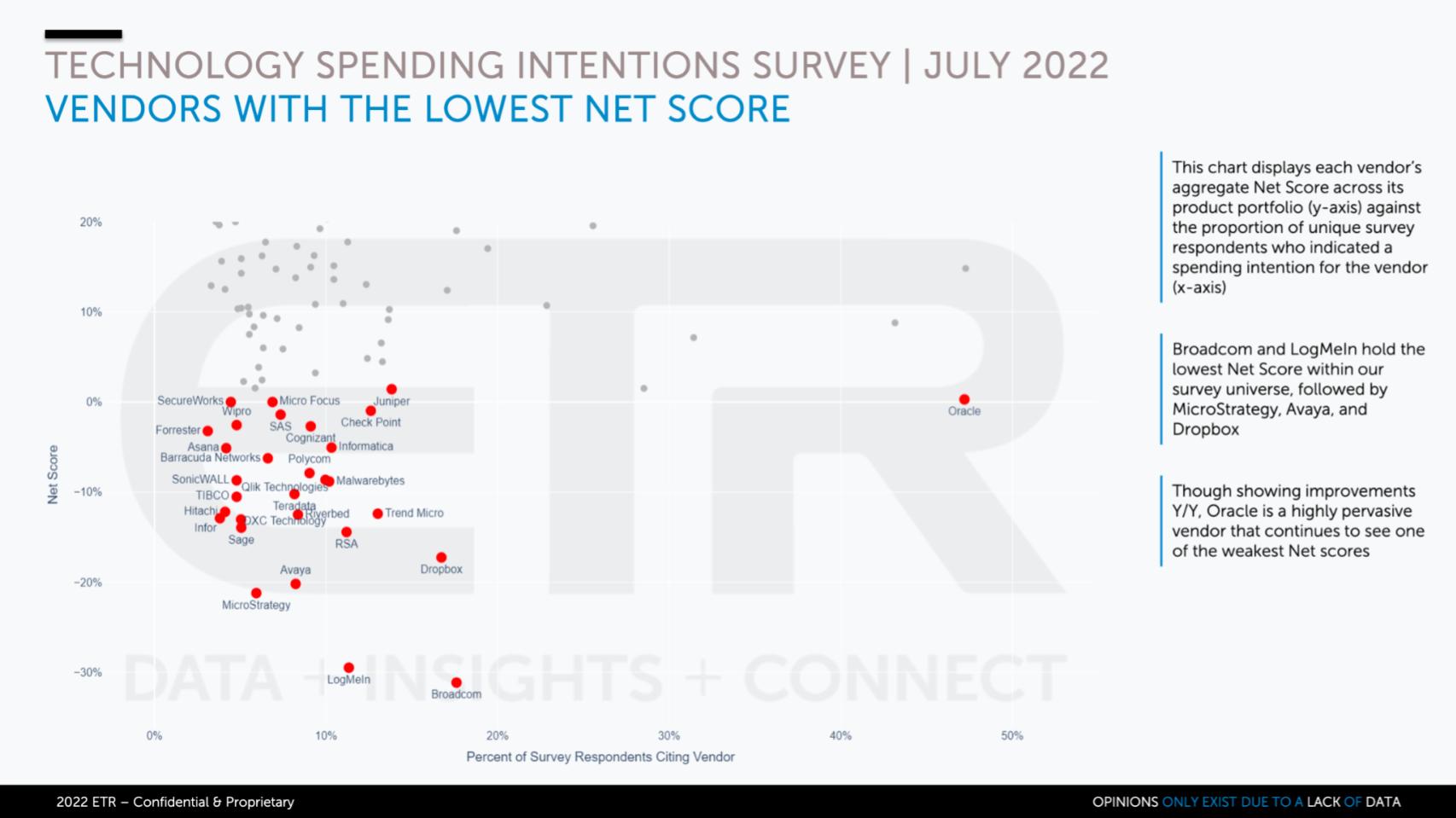

Now for the red team

There is no 40% line on the above chart because all these companies are well below that line. Now this doesn’t mean these companies are bad companies. It just means that a higher number of companies in the ETR survey are spending less than more on the particular company’s products and services. In other words, they don’t have the spending velocity of the ones we showed earlier.

A good example is Oracle Corp.: Look how it stands out on the X axis with a huge market presence. Despite its lower Net Score, Oracle remains an incredibly successful company selling to high-end customers and owning the mission-critical data and applications markets. And remember, ETR measures spending activity but not actual dollars. So companies such as Oracle, with big-budget customers, are not rewarded in the ETR surveys. Nonetheless, the fact remains that Oracle has a large legacy installed base that pulls down its growth rates, which ETR does capture.

Broadcom Inc. is another example. It’s one of the most successful companies in the industry. It’s not going after growth at all costs. It’s going after EBITDA, earnings before interest, taxes, depreciation and amortization, which ETR doesn’t measure.

So just keep that in mind as you look at this data.

How is spending velocity changing over time?

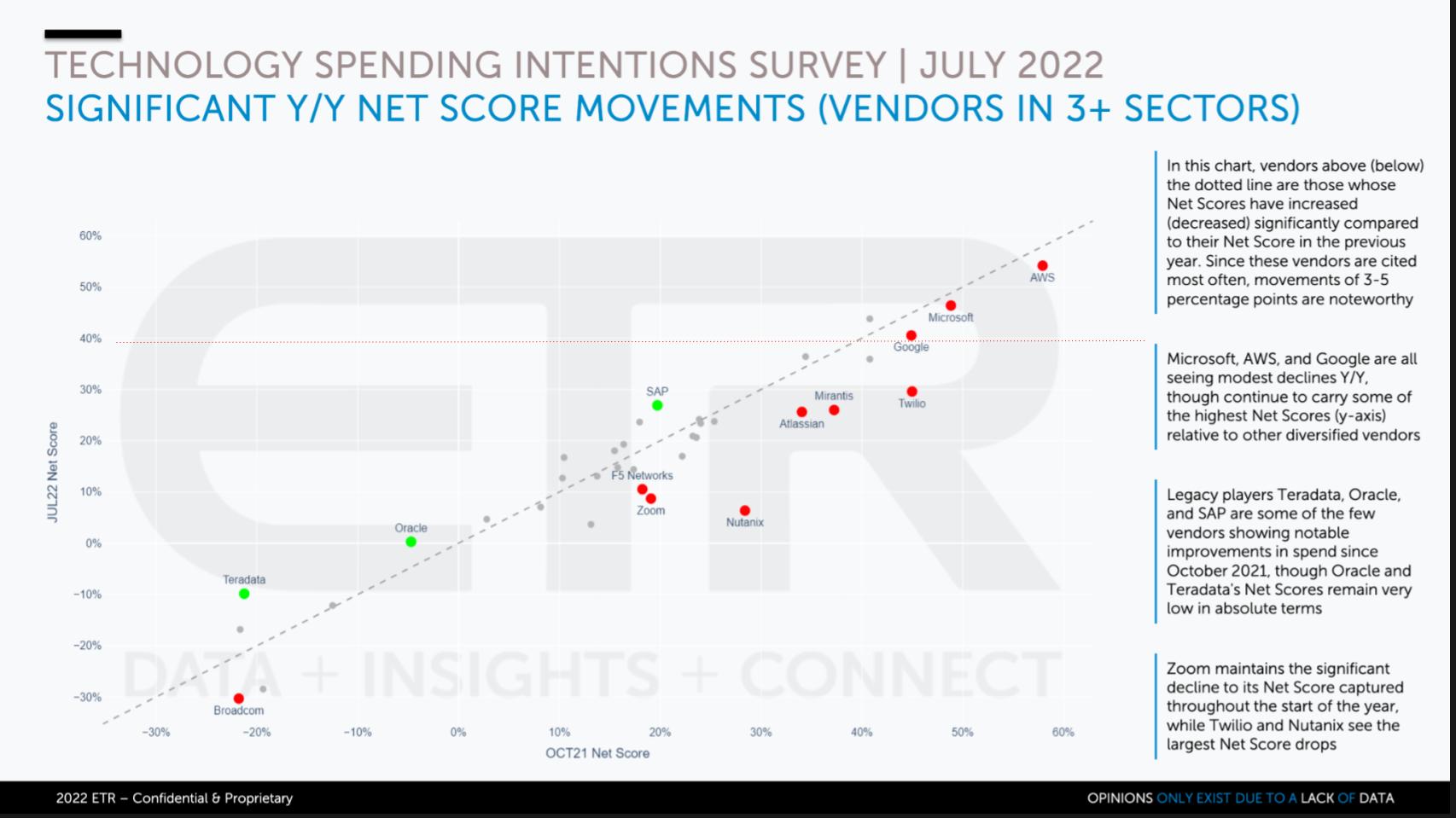

The chart above shows the year-over-year Net Score change for vendors that participate in at least three sectors within the ETR taxonomy. Names above or below the gray dotted line are those companies where the Net Score has increased or decreased.

Putting this in context with the earlier chart, it’s all relative, right? Oracle, while having lower Net Scores has also shown a more meaningful improvement than some of the others, as have SAP SE and Teradata Corp.

What’s impressive here is how AWS, Microsoft and Google LLC are actually holding the line pretty well. The other ironically interesting two data points here are Broadcom and Nutanix Inc. Broadcom is buying VMware Inc. and of course most customers are concerned about getting hit with higher prices. Nutanix, despite its change in Net Score, is in a good position to capture some of that VMware business. Just yesterday we talked to a customer who told us he migrated his entire portfolio off VMware, using Nutanix AHV, in an effort to avoid the “V-Tax.”

Now, this was a smaller customer and not representative of what we believe is Broadcom’s ideal customer profile. But Nutanix should benefit from the Broadcom acquisition if it can position itself to pick up the business Broadcom doesn’t want.

One person’s trash is another’s treasure….

Change in spending velocity for ‘pure play’ companies

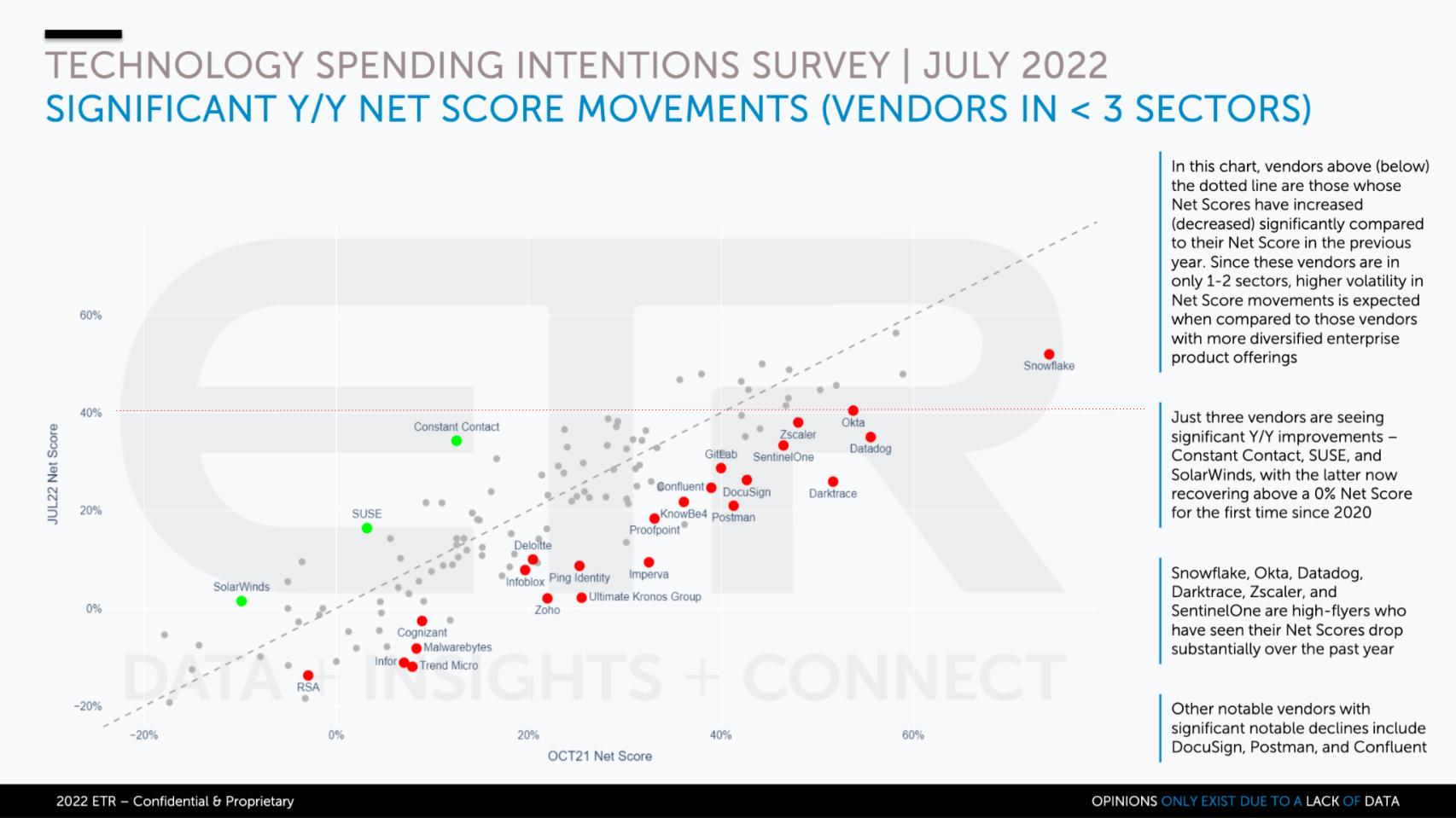

Above is the same chart as the previous one for companies that participate in two or fewer segments within the ETR taxonomy.

Only three names are seeing positive movement year over year in Net Score. SUSE Group, under the energizing leadership of Melissa Di Donato, is making moves. It went public last year and acquired Rancher Labs Inc. in 2020. We know Red Hat is the big dog in Kubernetes but since the IBM Corp. acquisition, but people have looked to SUSE as a potential alternative and it’s showing in the numbers. SUSE has a nice business and will do more than $600 million in revenue this year with solid double-digit growth. Its profitability is under pressure, but it’s definitely a player that has found a niche and is worth watching.

SolarWinds Worldwide LLC is maybe a bit of a dead cat bounce coming off the major breach – some of its customers just can’t move off the platform.

In that sea of red dots, there are many high-price-to-earnings ratio stocks – or infinite PE stocks that have no E – and we can see how their Net Scores have dropped. We’ve reported extensively on Snowflake Inc. – still No. 1 in Net Score but big moves off its highs. Okta, Datadog Inc., Zscaler, SentinelOne Inc. and Dynatrace Inc. all showing big downward moves along with the rest. So this chart really speaks to the change in expectations from the COVID bubble, despite the fact that many of these company’s CFOs would tell you the pandemic wasn’t necessarily a tailwind for them.

Bear market rally, time to buy or building a base: What do the technicians think?

The big question on people’s minds is: What’s going to happen to these tech companies in the stock market?

We reached out to both Erik Bradley of ETR, who used to be a technical analyst on Wall Street, and to longtime trader and frequent Breaking Analysis contributor Chip Symington to get a read on what they thought.

The first observation is the market has been off 11 out of the past 12 weeks and bear market rallies like what we’re seeing today happen from time to time.

Federal Reserve Chairman Jerome Powell’s testimony was viewed positively by the Street because higher interest rates are expected to push commodity prices down and weaken consumer sentiment, which may point to a less onerous inflation outlook.

Symington pointed out to Breaking Analysis awhile ago that the Nasdaq index has been on a trend line for the past six months where its highs are lower and the lows are lower and we’re bumping up against that trend line at these levels. What he means is if it breaks that trend it could be a buying signal as he feels that tech stocks are oversold.

He pointed to a recent and much-needed bounce in semiconductors and cited the Qualcomm Inc. example. Here’s a company trading at 12 times forward earnings with a sustained 14% growth rate and cash flow to support its 2.42% annual dividend.

So overall he feels this rally was expected. He’s cautious because we’re still in a bear market but he’s beginning to turn bullish.

Erik Bradley added that he feels the market is building a base here and he doesn’t expect a 1970s-80s yearlong sideways move because of all the money that’s still in the system. But it could bounce around for several months and, with higher interest rates, there will be more options other than equities, which for many years hasn’t been the case.

Obviously inflation and recession are like two looming towers that we’re all watching closely and will ultimately determine if, when and how this market turns around.

As always, we’ll be here watching the data and reporting material changes to our community.

Keep in touch

Thanks to Stephanie Chan, who researches topics for this Breaking Analysis. Alex Myerson is on production, the podcasts and media workflows. Special thanks to Kristen Martin and Cheryl Knight, who help us keep our community informed and get the word out, and to Rob Hof, our editor in chief at SiliconANGLE. And special thanks this week to Andrew Frick, Steven Conti, Anderson Hill, Sara Kinney and the entire Palo Alto team.

Remember we publish each week on Wikibon and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email [email protected], DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at [email protected].

Here’s the full video analysis:

All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE Media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

Disclosure: Many of the companies cited in Breaking Analysis are sponsors of theCUBE or clients of Wikibon. None of these firms or other companies have any editorial control over or advanced viewing of what’s published in Breaking Analysis.

Image: Tierney/Adobe Stock

Show your support for our mission by joining our Cube Club and Cube Event Community of experts. Join the community that includes Amazon Web Services and Amazon.com CEO Andy Jassy, Dell Technologies founder and CEO Michael Dell, Intel CEO Pat Gelsinger and many more luminaries and experts.

[ad_2]

Source link

More Stories

Why Information Technology is Key to Growth

Information Technology: Your Pathway to Innovation

Unlocking the Future of Information Technology