On Friday, a tale caught my eye. Viewers will rapidly remember the piece I wrote in regards to the romance involving BP PLC (BP) and Palantir (PLTR) . I kind of favored what each firms are doing, but not ample to pull both trigger just nonetheless. For Palantir, I saw the lock-up period expiration coming just three days just after upcoming Tuesday’s envisioned earnings release as a purpose to hold out. I did not see this morning’s deal in between Palantir and IBM (IBM) coming and that news had the inventory up 10% prior to the opening on Monday morning.

One more tale caught my eye this morning. I am guaranteed that by now most visitors have read a thing on the disclosure that Tesla (TSLA) had invested $1.5 billion in cryptocurrencies and would begin accepting bitcoin for payment in exchange for Tesla solutions “in the near future”. You probably keep in mind that about a 7 days in the past, for the duration of a Clubhouse audio application session, Tesla CEO Elon Musk stated that he was a supporter of bitcoin and that bitcoin was “actually on the verge of obtaining wide acceptance by conventional finance people today.” Musk was also amid a number of superior profile people that tweeted about a much lesser known cryptocurrency regarded as dogecoin previous 7 days as that a great deal less expensive (for every coin) crypto alternative soared, at the very least in share terms.

Speedy Ideas

I have experienced a quite reliable observe history investing Tesla, at minimum considering that I stopped trying to short this name a few of several years in the past. Even now, as effectively as the trading has long gone, I have no place correct now, and in hindsight, investing would have been smarter than investing this stock. One particular has to speculate just how favourable this information is for either Tesla or bitcoin. Each are up nicely on the information. I feel that the financial investment in bitcoin is a display of faith by Tesla in this crypto specially. That has worth. At the conclusion of the fourth quarter, a a few month time period exactly where Tesla ran with cost-free dollars movement of $1.9 billion, and amplified the firm’s internet posture of income and funds equivalents by $4.9 billion to $19.4 billion. So, they have some dollars and they need a thing to do with it. Guess Tesla could have compensated the shareholders a dividend, but very last year’s inventory break up unquestionably managed to pad the pockets of the firm’s investing general public.

So, why not? If bitcoin turns destructive as soon as once more, the stock’s valuation could take a strike, but then again, the dimensions of the financial commitment as a percentage of the firm’s dollars placement is not ample to wreck the business, and the bitcoin tale is better than it once was, at the very least potentially as the U.S. Treasury Office and the Federal Reserve Bank, along with several worldwide central banking institutions, are doing almost everything they can to not so overtly debase their fiat currencies. If which is how Elon feels, then his option investments would be ideal put in either bitcoin or actual physical gold. By accepting bitcoin in trade for either items or providers, Tesla also encourages the broader possession of this crypto, and bitcoin is world wide, this means it has a key rationale for remaining, obtaining wealth out of a failing currency and into a thing exchangeable anyplace else in the planet in any other reserve forex. The only capture there… would be that any shopper building use of bitcoin as a medium of exchange would also in impact be betting against bitcoin in U.S. greenback (or any fiat) conditions.

Regardless…

I consider now, possibly extra than projected creation degrees, or sales. Tesla may well be valued to at least some diploma, up or down with an trader view of bitcoin as element of the equation. In other phrases, for those people who have not long gone the more mile of investing in bitcoin specifically, investing in Tesla could be a semi-covert way of undertaking so. This could also reignite interest in shorting the title. Sure, bitcoin has proven itself handy as a means of transferring wealth and doing so rather anonymously. That stated, regulatory possibility will be an challenge transferring forward as the central banking companies facial area the prospective clients of competing with a forex-like products that continues to be exterior of the classic funds source. In other terms, cryptocurrencies, helpful kinds in specific, render central banking institutions fewer strong.

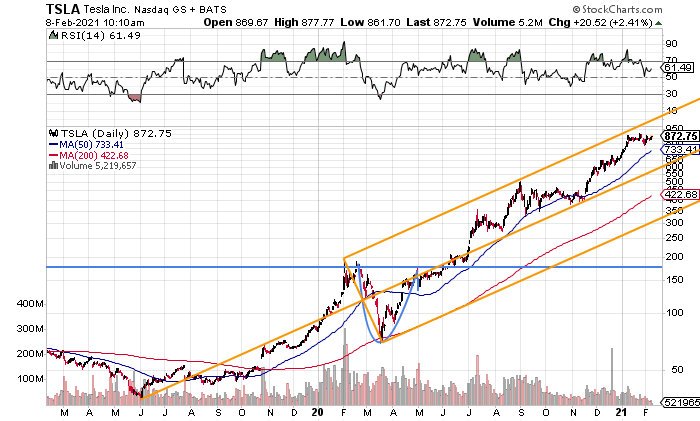

The Chart

Viewers will notice on this chart that the shares broke out of an ascending triangle in mid-November and have entered into what seems to be like it could be the get started of a time period of basing consolidation commencing with the new year. Relative Energy has eased as the shares of TSLA trade at a “mere” 18% top quality to their own 50 working day very simple moving common, which is variety of affordable for Tesla going back to that November breakout. Is this it? The very last gasp of an unbelievable rally? I imagine that may be untimely. Enable me display you a longer chart that I drew up for you way back again and have now extended.

The aged Andrews’ Pitchfork model, relationship again to the lows of Might/June 2019… that I believe I may be shut to the past market place participant earning use of, exhibit that not only is the upward trend nonetheless pretty much in tact, but the shares continue to be firmly entrenched in the higher chamber of the pitchfork as they have been because taking the central pattern line back again in late June 2020. Even pulling back again to the 50 working day line may well come about, and I would not be surprised if it did… that would do absolutely nothing to improve the trend. You give me the 50 day line, I might be a purchaser, and bitcoin would have almost nothing to do with it.

As for bitcoin, I have typically chosen bodily gold, as an choice retailer of wealth. That said, I ought to confess that should bitcoin locate use as a medium of exchange, it would attain at the very least 1 of the a few features of “revenue” that gold, at minimum for now, seems to have misplaced. Both can act as retailers of wealth. Both of those are divisible. Neither is commonly utilised as a medium of trade. If bitcoin were to achieve a broader use there, that would be a large feather in bitcoin’s cap. Then again, gold is however fantastic if the lights go out, bitcoin would be just long gone. Perhaps the argument is not bitcoin vs. gold, but bitcoin in addition to gold. Maybe.

Get an electronic mail alert every time I publish an short article for True Funds. Click the “+Stick to” subsequent to my byline to this short article.

More Stories

How News Technology is Shaping Public Opinion

Exploring Ethics in News Technology Practices

News Technology: Enhancing Audience Engagement