[ad_1]

Even with a mixed bag of earnings reports from tech businesses just lately, a fall in gross domestic solution this earlier quarter and increasing inflation, the cloud carries on its relentless growth on the data know-how landscape.

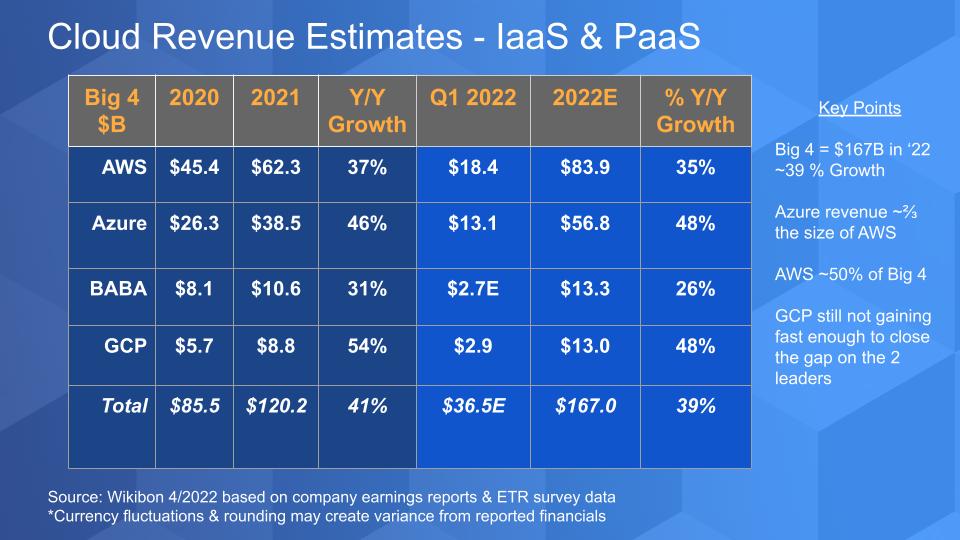

Amazon World-wide-web Companies Inc., Microsoft Corp. and Alphabet Inc. have all noted earnings and, when you contain Alibaba Group Holding Ltd.’s cloud in the mix, the massive four hyperscalers are on observe to crank out $167 billion in profits this 12 months based mostly on our projections.

But as we’ve stated several periods, the definition of cloud is growing. And hybrid environments are becoming the norm at key organizations. We’re viewing the largest organization tech organizations concentration on resolving for hybrid and just about every public cloud organization now has a approach to provide their environments closer to in which customers’ workloads stay – in knowledge facilities and the edge.

In this Breaking Examination, we’ll update you on our hottest cloud projections and outlook. We’ll share the most recent Business Technologies Investigation data and some commentary on what’s happening in the “hybrid zone” of cloud.

Big 4 hyperscale IaaS and PaaS general performance

In the chart earlier mentioned we share our huge 4 cloud shares for infrastructure as a services and system as a assistance for 2020, 2021, Q1 2022, our estimate for complete-yr 2022 and relative growth. Keep in mind, only AWS and Alibaba report rather thoroughly clean IaaS and PaaS figures, whereas Microsoft and Google bundle their cloud infrastructure in with their software program as a provider figures. Each companies, even so, give advice and we use survey details and other tidbits to develop an apples-to-apples comparison.

For the quarter, the massive 4 approached $37 billion in revenue as a group. Azure’s expansion charge is claimed by Microsoft, but the absolute profits quantity is not. Azure advancement accelerated sequentially by 49% to just in excess of $13 billion in the quarter by our estimates, though AWS’ expansion moderated sequentially but profits nonetheless hit $18.4 billion. Azure is a lot more than two-thirds the measurement of AWS’ cloud organization. Google Cloud Platform and Alibaba are preventing for the bronze medal but properly driving the two leaders. Microsoft’s Azure acceleration is fairly impressive for this kind of a substantial profits foundation, but it is not unparalleled as we’ve witnessed this sample right before with AWS. Nonetheless, the simple fact that Azure is increasing at the similar amount as GCP is pretty spectacular.

A couple other tidbits: Amazon stock received hammered the working day after it announced earnings for the reason that of inflation and slowing growth costs. But AWS proceeds to defeat Wall Street’s anticipations. A glimpse at Amazon’s running revenue this quarter tells the tale. Amazon overall had an running loss of $3.66 billion. AWS’ operating earnings was $6.52 billion. AWS’ working margin grew sequentially from virtually 30% to 35.3% – an astoundingly lucrative determine. This is equivalent to very lucrative firms these kinds of as Oracle Corp. and Microsoft — application organizations with application marginal economics. Is that level sustainable? Likely not, but it is eye-opening however.

Breaking down the paying out patterns on the major 4

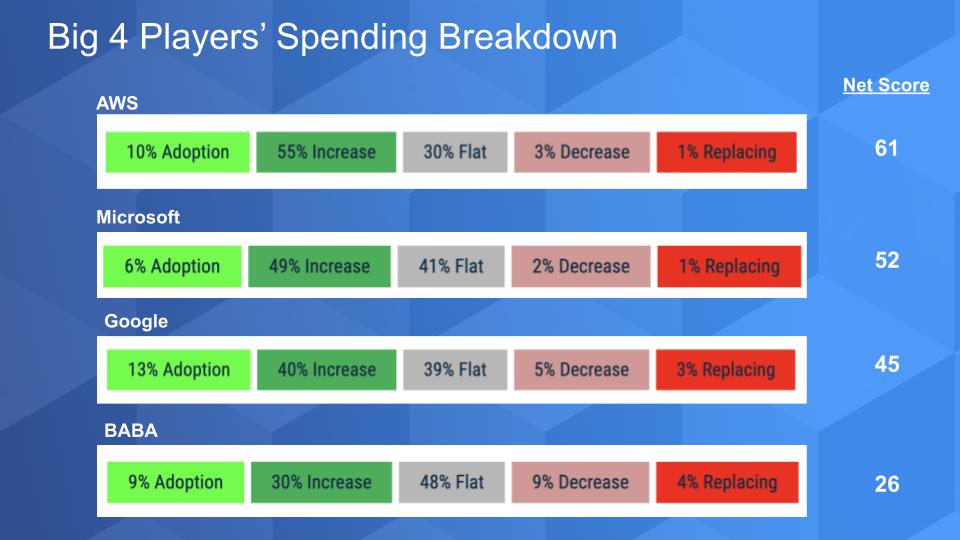

The chart above demonstrates the Web Score granularity for the huge 4 cloud players. Web Score steps investing momentum by asking consumers if they are adopting new – that is the lime green expanding shell out by 6% or extra – which is the forest environmentally friendly flat shell out is the gray spend dropping by 6% or even worse – that’s the light pink and the red is decommissioning the system. Subtract the reds from the greens and you get a Internet Score shown on the right. Something over 40% is very elevated.

The crucial details right here are as follows: The Microsoft details above incorporates the company’s total company – not just cloud. Its Azure-only Net Score is 67 — larger than even AWS’. That is enormous. Google Cloud, on the other hand, though nonetheless elevated, is well powering the two leaders. Alibaba’s knowledge sample in the ETR study is modest and China has had its foot on the neck of large tech for a even though, so we can’t study too considerably into a Internet Rating of 26.

But discover the replacements in crimson – one digits for all and very low single digits for the two giants – 1% – incredibly extraordinary.

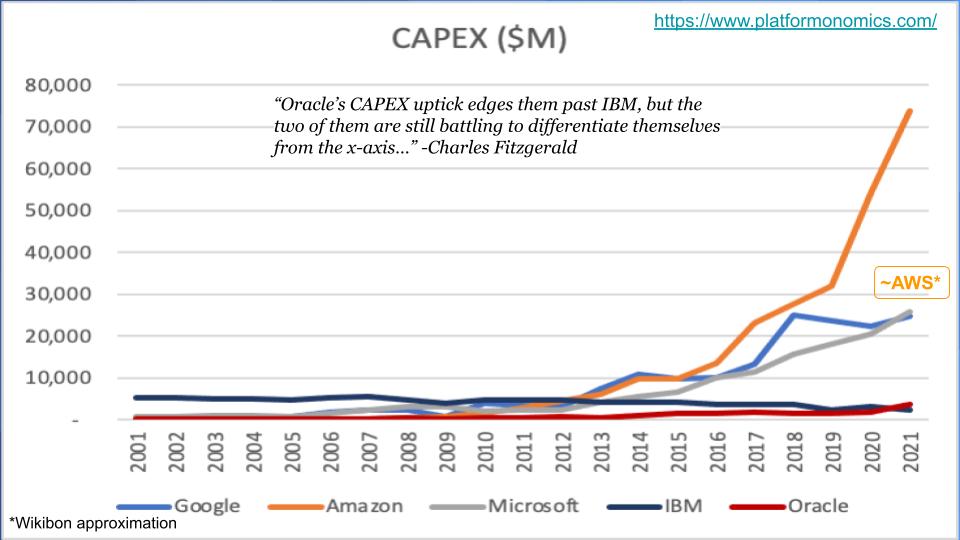

Funds shelling out tells the story

Capex devote tends to be a fairly good indicator of scale. Charles Fitzgerald, who operates the Plaformonomics weblog, spends a good deal of time on this subject and we borrowed the chart underneath from a the latest submit – and extra some estimates of our have.

It exhibits Capex commit above time for five cloud businesses – the significant 3 U.S. companies moreover IBM Corp. and Oracle. It’s generally astounding to go back again to the pre-cloud era and appear at IBM. The enterprise was in a fantastic situation to dominate the changeover to as-a-support but could not get its head around cloud and out of its specialist providers and outsourcing companies. IBM is that dark blue or black line. It was outspending Amazon in Capex very well into the previous 10 years. Exact with R&D devote, by the way.

Charles is a bit of a snark – he enjoys to make entertaining of our supercloud concept even while we’re self-confident it is evolving and is real. But his point earlier mentioned is ideal on. The huge a few U.S. gamers devote considerably extra on Capex than IBM and Oracle. He jokes that Oracle’s uptick in Capex expend places it previous IBM, but the two of them are battling to length on their own from the X axis. Humorous guy.

In its recent earnings report, Amazon stated that about 40% of its Capex goes to infrastructure and most of that to AWS. It expects Capex to mature this calendar year and all-around 50% will go toward infrastructure, so we’ve superimposed our estimate of the place AWS lands.

As soon as once again Microsoft is notable since not like Amazon, it does not have a zillion warehouses to ship merchandise to individuals. And even though Google’s shelling out is substantial, it’s primarily on servers to electricity its advert network. Of class, GCP can leverage that infrastructure and the tech powering it. And it does.

And so can every person else leverage all this Capex spend. We’ll arrive back again to that and converse about supercloud in a instant.

The at any time-expanding cloud landscape

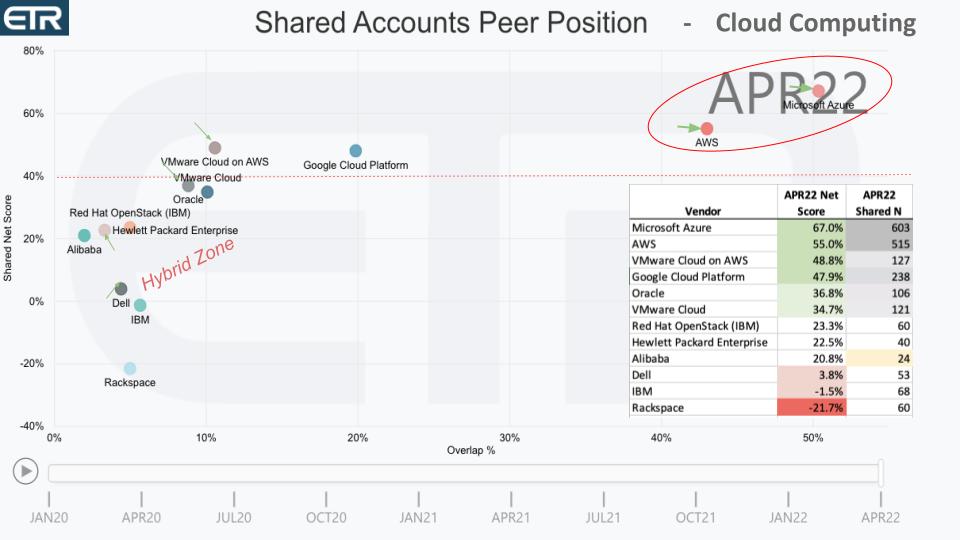

The chart above shows a two-dimensional watch of the ETR data for cloud computing. On the vertical axis is Internet Score or investing momentum and on the horizontal axis is pervasiveness in the facts established. The X axis is like industry share in the study, if you will. The desk insert demonstrates the details for how the dots for every seller are plotted on each axis.

The red dotted line at 40% indicates a highly elevated posture. And the inexperienced arrows exhibit the motion for some corporations relative to a few months ago.

Microsoft and AWS are circled in crimson way up in the appropriate hand corner. Quite remarkable. Just to decrease clutter, we’re not demonstrating AWS Lambda and some other highly elevated providers that would push up AWS’ Web Rating. But it’s nevertheless actually really good… as is Azure’s. They’re the two moving solidly to the appropriate relative to very last quarter’s survey.

Google is properly driving and has substantially work to do. It was announced this previous 7 days that the head of sales at Google Cloud, Rob Enslin, is leaving to join UiPath Inc… some interesting news there.

We’ve highlighted the “Hybrid Zone.” Now to the theme of this Breaking Examination – the at any time-increasing cloud. AWS declared that it has concluded the launch of 16 area zones in the U.S. and there are 32 a lot more coming throughout 26 countries. Area Zones fundamentally bring cloud infrastructure to areas wherever there’s a good deal of IT that is not likely to move. And for proximity and latency factors, they have to move nearer to the buyers. There’s that Capex buildout coming into engage in yet again.

Now the cause this hybrid zone turns into intriguing is you’re looking at the big company gamers eventually heading just after the hybrid cloud in earnest. It is pretty much like the AWS Outposts announcement in 2018 was a wakeup connect with to conventional infrastructure players these types of as Dell Systems Inc., Hewlett Packard Company Co. and IBM. Oracle is form of skipping to its possess tune, but it is in that hybrid zone as well. IBM experienced a good quarter and the Crimson Hat acquisition appears to be to be doing work to help its hybrid cloud technique.

VMware Inc. several a long time back cleaned up its fuzzy cloud tactic and partnered up with everyone. And you see previously mentioned, VMware Cloud on AWS executing nicely, as is VMware Cloud, its on-premises providing. Even although it is rather decreased on the X-axis relative to very last quarter, it is relocating to the proper with a higher existence in the info established.

Dell and HPE are also intriguing. Each providers are likely tough soon after as-a-provider with APEX and GreenLake, respectively. HPE, primarily based on the survey knowledge from ETR, appears to have a guide in investing momentum, even though Dell has a much larger presence in the survey as a considerably even larger corporation. HPE is climbing up on the X axis, as is Dell, whilst not as immediately.

And the point we come again to generally is that the definition of cloud is in the eye of the consumer. AWS can say, “That’s not cloud.” And the on-prem group can say, “We have cloud as well!” It really does not issue. What matters is what the purchaser thinks and in which platforms they pick out to commit.

That’s why we continue to keep circling back again to the thought of supercloud. You are observing it evolve and you’re going to hear much more and additional about it. Perhaps not the term – quite a few don’t like it – but we’ll carry on to use it as a metaphor for a layer that leverages the Capex present the significant hyperscalers are giving the market. This is a genuine prospect for the likes of Dell, HPE, IBM, Cisco Units Inc. and dozens of other companies giving compute and storage infrastructure, networking, stability, database and other areas of the stack. It is different to us than multicloud, which is genuinely multivendor– that is, my stack operates on clouds 1, 2 and 3 as a bespoke company.

The prospect in our view is to conceal the fundamental complexity of the cloud, working with all the application programming interface and primitive muck, generating a singular knowledge across on-prem, throughout all the clouds and out to the edge. We see this as a new struggle shaping up and new chances for startups to aid. It will be pricey to make and will demand ecosystem cooperation throughout the API economic system to make it a fact. There is a definite shopper want for this frequent expertise and in our check out we’re seeing it manifest in pockets today and in R&D projects in just both equally startups and set up gamers.

In our see, it is the long term of cloud for any firm that can not commit $30 billion a calendar year on Capex.

Maintain in touch

Many thanks to Stephanie Chan, who investigated topics for this Breaking Evaluation. Alex Myerson is on generation, the podcasts and media workflows. Special many thanks to Kristen Martin and Cheryl Knight, who assistance us retain our neighborhood knowledgeable and get the phrase out, and to Rob Hof, our editor in main at SiliconANGLE.

Try to remember we publish each 7 days on Wikibon and SiliconANGLE. These episodes are all obtainable as podcasts where ever you pay attention.

Email [email protected], DM @dvellante on Twitter and remark on our LinkedIn posts.

Also, examine out this ETR Tutorial we developed, which describes the paying out methodology in additional element. Note: ETR is a individual firm from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s knowledge, or inquire about its products and services, remember to contact ETR at [email protected].

Here’s the full movie assessment:

https://www.youtube.com/check out?v=Y7g96HIQQJU

All statements made regarding companies or securities are strictly beliefs, points of view and thoughts held by SiliconANGLE media, Enterprise Engineering Analysis, other visitors on theCUBE and guest writers. These types of statements are not tips by these people today to obtain, provide or keep any protection. The content material introduced does not constitute expense tips and need to not be utilised as the basis for any investment decision. You and only you are accountable for your expenditure choices.

Graphic: jijomathai/Adobe Stock

Clearly show your assistance for our mission by signing up for our Dice Club and Cube Celebration Local community of industry experts. Sign up for the neighborhood that includes Amazon World-wide-web Services and Amazon.com CEO Andy Jassy, Dell Technologies founder and CEO Michael Dell, Intel CEO Pat Gelsinger and numerous much more luminaries and experts.

[ad_2]

Supply hyperlink

More Stories

Why Information Technology is Key to Growth

Information Technology: Your Pathway to Innovation

Unlocking the Future of Information Technology